If you ask seasoned investors what the biggest risks are when investing in real estate syndication, most will tell you in order: the sponsor, the market, and then the property. With that in mind, we’ve created a 3-part series to help passive investors know what we look for and what they should look for when it comes to passive real estate investments. If you missed part 1, you can find it here. This second installment will focus on evaluating the market for real estate syndications.

It is often said that location is the #1 rule in real estate. When I launched the Target Market Insights podcast, I did so because I wanted to learn how the most successful investors were evaluating markets and finding the path of progress in any metro. I had a lot of success with my personal portfolio but needed a more sophisticated approach as we scaled. In addition, I wanted to find opportunities along the path of progress, even before locals in the market.

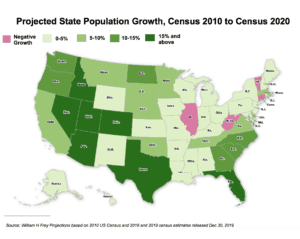

What I found from talking to investors, brokers, and specialists from all over the country, is that the submarket dynamics are more important than the macro-level dynamics. For instance, the Chicago MSA has lost population for 3 straight years, but the Near West Side neighborhood has exploded over that same stretch. When it comes to investing in apartment syndications, it’s critical to understand both the macro-level dynamics, as well as the submarket dynamics shaping the opportunity and business plan.

In the first installment, we stated that the operator is the most important aspect of any syndication and that extends into all phases of the evaluation. You’re evaluating the operator’s knowledge of the market and the specific submarket where the property is located. You want to know that this market will have future demand that matches or exceeds the projections from the operator. Critical components you want to understand are the current economic trends, multifamily trends, and corresponding future projections in the business plan. Much of this data is publicly available and you can keep reading for some key metrics and resources to follow.

Key Metrics to Analyze Real Estate Markets

-

Population & Population Growth

-

Job Growth and Industry Diversification

-

Affordability

-

Apartment Supply and Demand

-

Landlord Laws and Regulations

-

Submarket Drivers

Population & Population Growth

One of the first and primary factors for selecting a market is the current population and population growth. First, you’ll want to know the size of the Metropolitan Statistical Area (MSA). Is this a primary MSA (5MM+ people), secondary MSA (2-5MM) or tertiary MSA (less than 2MM)? You’ll want to see if there is positive migration into the market or if people are leaving. You’ll generally want to see the population growth in both the MSA and sub-market levels. However, a loss in the population may not be an immediate disqualification, but it should certainly make you more cautious and ask more questions regarding the market health and business plan.

Once you identify the current population trends, you’ll want to understand what’s driving it. Are these factors likely to continue? Based on what? What plans are in the works that can accelerate or alter the current trajectory?

Job Growth and Industry Diversification

Next is evaluating the jobs in the market. You’ll want to look for employment growth and understand which industries and which companies are seeing growth. We look for job diversification with no more than 25% of jobs from one industry in a market. Job diversification helps to protect against industry swings such as oil and automotive which have had drastic impacts on Houston and Detroit as an example. Now, this isn’t a hard-fast rule meaning to never look at these markets, but you should certainly take extra precaution if you plan to proceed in a market where one industry has a large percentage of the jobs. One of our markets, Cincinnati has a strong reliance on education and health care, but these industries tend to prosper when the economy suffers, so we believe this is a calculated risk.

I like to look at top employers for the area and glance at their latest quarterly report. I want to see if sales are up and they have expansion plans or if sales are sluggish and job cuts are on the way. These reports give a great view into the organization’s plans.

Affordability

When reviewing markets, pay attention to affordability. You can compare average rents against average incomes and see if the market is affordable for most residents. Another great gauge is to see the percentage of renters in the area. Most people use screening criteria that a prospect’s monthly income must be 3x the rent. We want to ensure the area we’re selecting will give us a broad pool of qualified renters, so we often look to set this at 4x the rent when selecting a market.

The key watch out is to ensure that the renovated rent projections are still affordable and achievable for the area. Some operators over-improve properties just to find out there is little demand for units at that price level. Renters are seeking value as well and will have no problem moving down the street if they see a better deal.

Apartment Supply and Demand

Next is a big one that many investors overlook. Ultimately, we’re trying to gauge demand for apartments. Just because you have a growing population with a growing diverse employment base does not make it a slam dunk market. Other investors and developers are looking at the same data to build and redevelop in these markets and supply can quickly outpace demand. When this happens, you see rent concessions (e.g. first month’s rent free) and a slowing of rent growth. It’s important to understand the number of new developments and the net absorption of new supply when forecasting future rents.

Most developers today are building Class A luxury apartments, so investing in Class B or C apartments can help to insulate you from new development. We focus on value-add Class B and C multifamily, which attracts a different renter than Class A apartments. Even still, it’s critical to understand the existing supply and demand for the different unit types in an area.

Landlord Laws and Regulations

Like with any business investment, you will want to understand the local policies that govern the industry. In this case, our business is providing apartment housing, so you want to know about tenant rights and eviction policies. In some areas, tenant rights have been over-emphasized with severe punishments for property owners for minor infractions that should be more of a technicality. In Chicago, returning a $1,700 security deposit, but not paying the $0.17 in interest could cost an owner roughly $5,100 (penalty of 2x security deposit, court costs, attorney fees for themselves and the tenant). Yes, that’s a $5,099.83 penalty for not paying the 0.01% interest rate of 17 cents!

Now there are ways around this of course, but the larger point is to try to operate in areas where the laws are favorable to landlords or at a minimum ensure that the operator knows these rules and has a plan to minimize the risk to drive predictable results. We are making projections and these projections become more accurate the better we can limit the unknowns. Unfavorable policies and future policy changes can create more chaos, so we tend to prefer locations with amenable local governments.

Submarket Drivers

Now that, we’ve identified the broad strokes of market evaluation, let’s look more specifically at the submarket for a deal you may be vetting. Residents are attracted to areas for schools, employment, safety, lifestyle, transportation, community amenities, and affordability. You’ll want an area that has a mix of these, although finding all of them is less likely in a Class C community.

The operator should have a strong sense of what is needed to execute the business plan based on the submarket drivers and dynamics. Often times, the property manager is a great resource for this information as they talk to residents every day. The plan should be vetted with the property management firm to ensure the strategy is sound.

As you evaluate markets, I thought it would be helpful to include a list of questions that will help you evaluate the market, as well as some of the resources we use for reviewing market data. Keep In mind that the ability of the operator to execute in that market is much more important than just selecting a great market, so you’ll want to use these questions to help you learn more about the operator, as well as learning more about the location. In part 3, we’ll talk about how to evaluate the actual deal.

Market Questions to Ask the Operator:

-

Why did you select [market] as your target market?

-

Who else do you know in [market]? What did they say about the area?

-

How many times have you been to [market]?

-

Who are the top employers in [market]? How is their business?

-

Why would someone want to live in this particular area?

-

What amenities is this area known for? E.g. good schools, close to expressways, major employers, family parks, etc.)

-

Describe the new resident you plan to attract? Where will they come from? Why would they move?

-

What kind of crime do you see in the area?

-

What’s driving the current trends in the area? Is this likely to continue?

-

What’s the average household income (HHI) for the area? How does this compare to average rents?

-

What’s the occupancy of comparative apartments?

-

How many new units are planned for the area? Will they be absorbed?

-

Is this area landlord-friendly? What’s the eviction policy?

Market Data Resources

Economic Trends:

US Census

Bureau of Labor Statistics

Local Economic Development Council

Multifamily Trends:

Collier’s International

Marcus and Millichap

CBRE

CoStar

REIS Reports

ALN Data

Integra Realty Resources (IRR)

WeAreApartments.org

JusticeMap.org

The next article in this series will focus on reviewing the actual deal. If you like this article and want to get more multifamily tips and exclusive investment opportunities, join our private list today.